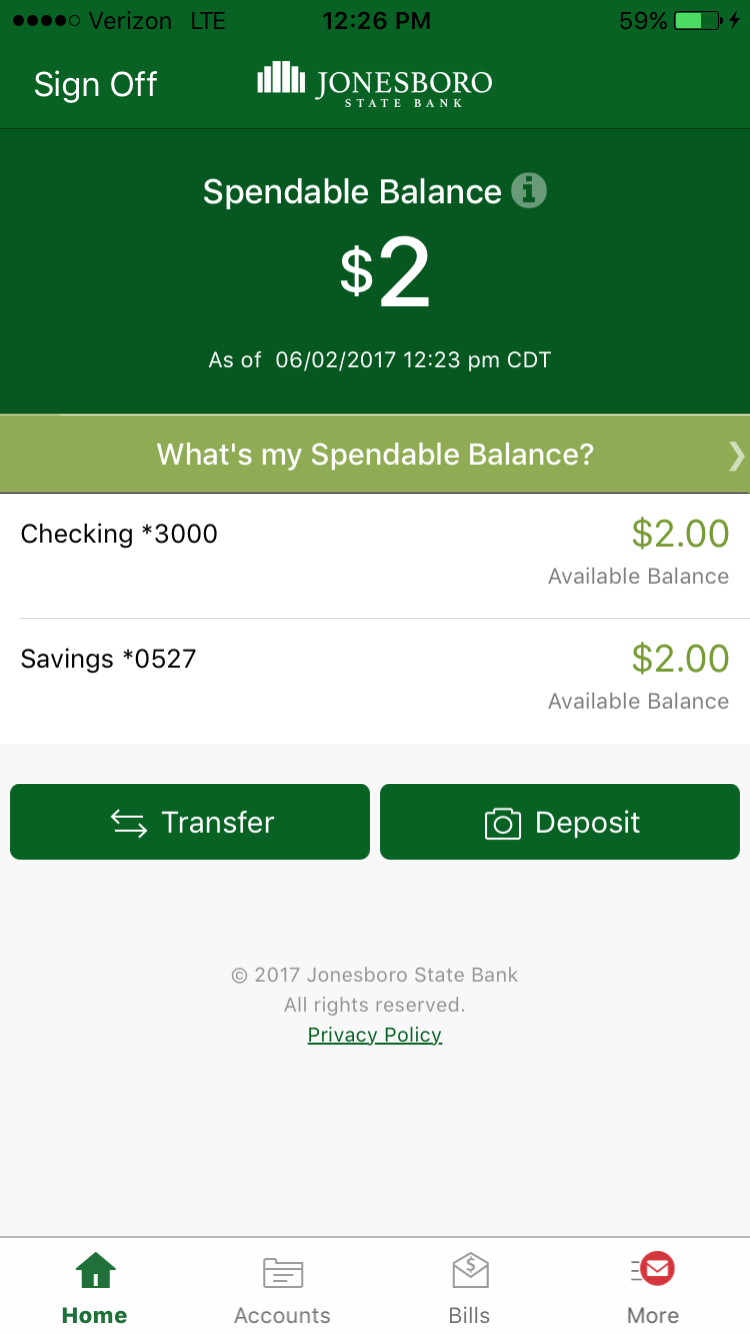

Sharing financial information online has become increasingly common in today's digital age, but it’s crucial to understand the implications of doing so. A screenshot of bank account balance might seem harmless, but it can expose sensitive data to unintended recipients. This article dives deep into the importance of safeguarding your personal financial information, how to securely capture and share screenshots, and the potential risks involved. Whether you're sharing with a trusted friend, a financial advisor, or for record-keeping purposes, this guide equips you with the knowledge to make informed decisions.

With the rise of digital banking, individuals are often required to provide proof of funds for various reasons, such as applying for loans, renting apartments, or even purchasing high-value items. While a screenshot of bank account balance serves as a convenient tool for verification, it is essential to exercise caution. This article explores the best practices for taking screenshots, understanding privacy settings, and ensuring your financial information remains secure.

As more people rely on mobile banking apps and digital wallets, the frequency of sharing financial screenshots has increased. However, it's vital to recognize the potential vulnerabilities associated with this practice. This article not only addresses the technical aspects of capturing screenshots but also emphasizes the importance of protecting your personal information from unauthorized access. Let’s delve into the details of how you can stay safe while sharing your financial data.

Read also:Bob Vila Net Worth A Comprehensive Look At The Renowned Home Improvement Experts Wealth And Legacy

What Should You Know Before Taking a Screenshot of Bank Account Balance?

Before you take a screenshot of your bank account balance, it's essential to consider the implications of sharing such sensitive information. Financial data is highly valuable, and even a seemingly harmless screenshot can lead to identity theft or fraud if it falls into the wrong hands. Here are some key points to keep in mind:

- Understand the purpose of sharing: Determine why you need to share the screenshot and whether it’s necessary to include all the details.

- Limit the information: Crop or blur unnecessary details like account numbers, addresses, or other personal identifiers.

- Use secure platforms: Ensure that the platform you're sharing the screenshot on is encrypted and secure.

Why Is It Important to Protect Your Screenshot of Bank Account Balance?

Protecting your screenshot of bank account balance is crucial for maintaining your financial security. Financial data breaches can lead to severe consequences, including unauthorized transactions, identity theft, and damage to your credit score. Here’s why safeguarding your information is important:

- Prevent unauthorized access: By securing your financial data, you reduce the risk of unauthorized individuals gaining access to your accounts.

- Avoid legal complications: Sharing too much information can lead to legal issues, especially if the data is misused.

- Maintain privacy: Protecting your financial details ensures that your personal life remains private and secure.

How Can You Securely Take a Screenshot of Bank Account Balance?

Taking a secure screenshot of your bank account balance involves several steps to ensure your information remains protected. Here’s how you can do it:

- Use built-in cropping tools: Most smartphones and computers come with built-in tools that allow you to crop your screenshot, ensuring only the necessary information is visible.

- Enable privacy settings: Check your device’s privacy settings to ensure that screenshots are not automatically uploaded to cloud services.

- Encrypt your files: If you plan to store the screenshot on your device, consider encrypting the file for added security.

Who Can You Safely Share Your Screenshot of Bank Account Balance With?

When deciding who to share your screenshot of bank account balance with, it’s important to evaluate the trustworthiness of the recipient. Sharing financial information should be limited to trusted individuals or entities, such as:

- Financial advisors or accountants

- Landlords or property managers

- Loan officers or banks

What Are the Risks of Sharing Your Screenshot of Bank Account Balance?

While sharing a screenshot of bank account balance may seem straightforward, there are inherent risks involved. These risks include:

- Data breaches: If the recipient’s system is compromised, your financial information could be exposed.

- Identity theft: Unauthorized access to your financial details can lead to identity theft and fraud.

- Human error: Mishandling the screenshot or sending it to the wrong person can result in unintended consequences.

Can You Redact Sensitive Information in a Screenshot of Bank Account Balance?

Yes, you can redact sensitive information in a screenshot of bank account balance to protect your privacy. Here’s how:

Read also:Discovering The Best Shopping Experience At Walmart Flatbush Hartford

- Use photo editing software: Tools like Photoshop or GIMP allow you to blur or black out specific details.

- Utilize built-in redaction features: Some devices and apps come with built-in redaction tools that make it easy to hide sensitive information.

- Verify the redaction: Always double-check that the redacted information is no longer visible before sharing the screenshot.

What Are the Best Practices for Sharing Financial Screenshots?

Adopting best practices for sharing financial screenshots is essential for maintaining your security and privacy. Here are some tips:

- Limit the audience: Only share the screenshot with individuals or entities who absolutely need it.

- Use secure channels: Opt for encrypted messaging apps or secure email services when sharing sensitive information.

- Delete after use: Once the screenshot has served its purpose, delete it from your device and any cloud storage services.

How Can You Verify the Recipient’s Security Measures?

Before sharing a screenshot of bank account balance, it’s important to verify the recipient’s security measures. Ask the following questions:

- Do they use encryption for data storage and transmission?

- Do they have a history of data breaches?

- What is their policy on handling sensitive information?

Is It Safe to Upload a Screenshot of Bank Account Balance Online?

Uploading a screenshot of bank account balance online can be risky if not done securely. To minimize risks:

- Use password-protected file-sharing services.

- Ensure the website or platform uses HTTPS encryption.

- Limit the time the screenshot is accessible online.

Conclusion: Balancing Convenience and Security

In conclusion, while taking and sharing a screenshot of bank account balance can be convenient, it’s crucial to prioritize security and privacy. By following the best practices outlined in this article, you can protect your financial information and avoid potential pitfalls. Remember, your financial data is valuable, and safeguarding it is essential for maintaining your financial well-being.

Table of Contents

- Securely Sharing Your Financial Details: A Guide to Screenshot of Bank Account Balance

- What Should You Know Before Taking a Screenshot of Bank Account Balance?

- Why Is It Important to Protect Your Screenshot of Bank Account Balance?

- How Can You Securely Take a Screenshot of Bank Account Balance?

- Who Can You Safely Share Your Screenshot of Bank Account Balance With?

- What Are the Risks of Sharing Your Screenshot of Bank Account Balance?

- Can You Redact Sensitive Information in a Screenshot of Bank Account Balance?

- What Are the Best Practices for Sharing Financial Screenshots?

- How Can You Verify the Recipient’s Security Measures?

- Is It Safe to Upload a Screenshot of Bank Account Balance Online?